Sam Bankman-Fried, once hailed as a crypto prodigy, now faces a 25-year sentence for his role in an $8 billion fraud that rocked the cryptocurrency world.

But while he languishes in prison, his opulent Bahamas real estate empire is about to hit the market, signaling the end of an era of excess and deceit.

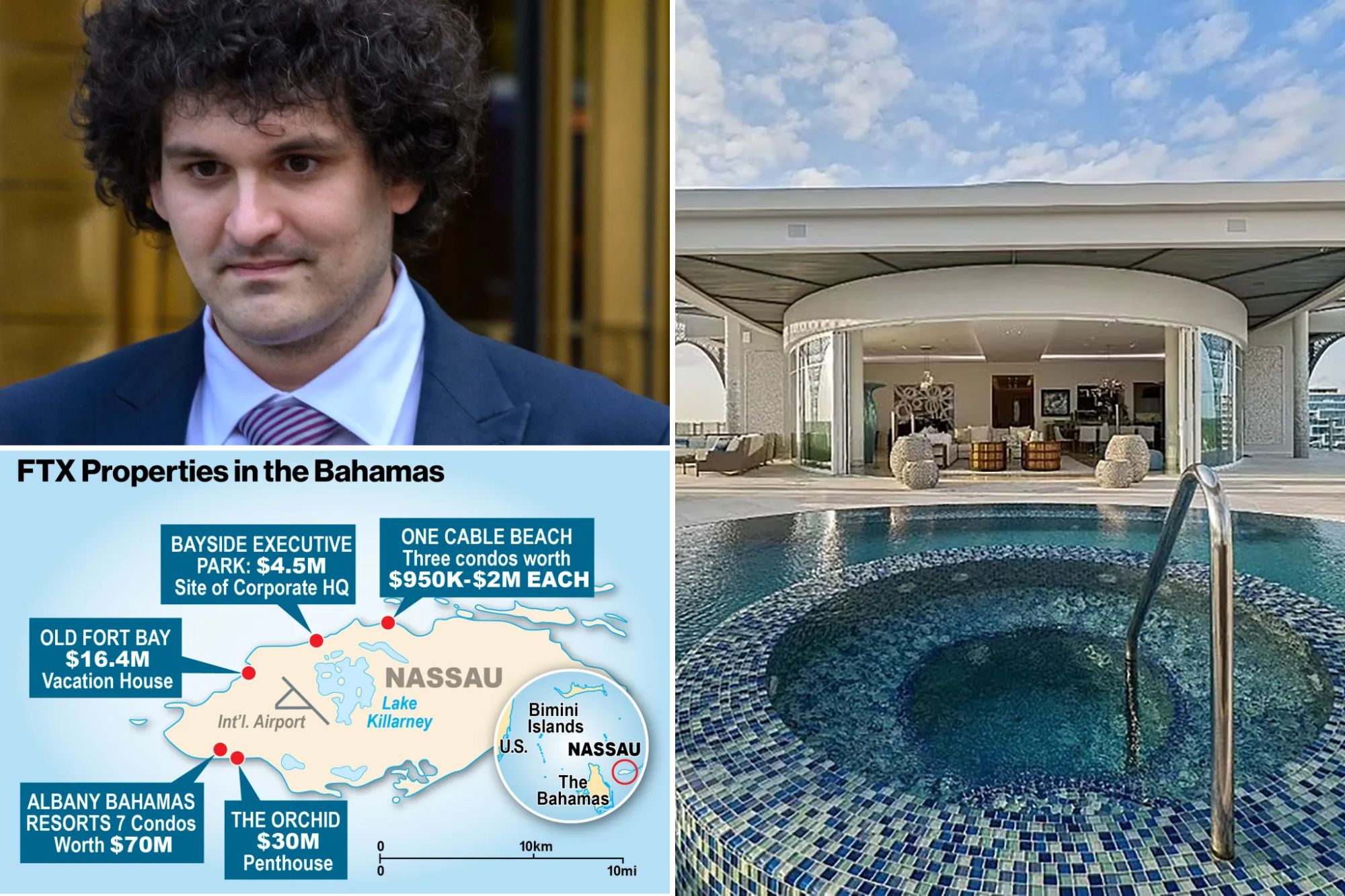

Before his spectacular downfall, Bankman-Fried lorded over a vast property portfolio in Nassau, the epicenter of his now-defunct cryptocurrency exchange, FTX, which imploded in 2022.

His lavish lifestyle was built on a foundation of fraud, according to prosecutors who claim he siphoned billions from unwitting clients to fuel his extravagant spending sprees.

Now, after a protracted legal battle, FTX has wrested control of some 38 properties worth a staggering $222 million from Bankman-Fried and his cronies.

Among the seized assets is the infamous waterfront penthouse where the disgraced tycoon once held court with a revolving door of roommates.

But as FTX moves to liquidate these ill-gotten gains to repay creditors, including thousands of defrauded customers owed a whopping $16 billion, a new chapter unfolds in this sordid saga.

The sale, overseen by federal bankruptcy court in Delaware, promises to inject fresh capital into a beleaguered crypto landscape still reeling from the fallout of Bankman-Fried’s scheme.

Luxury condos, beachfront estates and prime commercial real estate — Nassau’s most coveted addresses — are all up for grabs in what promises to be a frenzied bidding war.

According to Matthew Marco, a luxury real estate guru with Bond Bahamas, eager buyers should brace for stiff competition and sky-high prices.

“The demand for these types of properties is off the charts,” Marco told Realtor.com. “Don’t expect any bargains.”

Orchid building penthouse

Perched atop the Orchid building in Albany Bahamas, a ritzy resort enclave favored by golf great Tiger Woods, lies the crown jewel of Sam Bankman-Fried’s former real estate empire.

This opulent penthouse, acquired for a cool $30 million back in March 2022 by an FTX subsidiary, was initially earmarked as a plush abode for top brass within the company’s ranks, as per Reuters records.

Spanning five bedrooms and a sprawling 12,000 square feet, the penthouse boasts a private balcony offering sweeping vistas of the resort’s superyacht marina, complete with its own lounge and spa area.

But this luxe haven wasn’t just Bankman-Fried’s personal playground. It also served as a crash pad for his inner circle, including FTX bigwigs Zixiao “Gary” Wang and Nishad Singh — alongside Caroline Ellison, his on-again, off-again flame, who steered the affiliated hedge fund Alameda Research.

All three, implicated in the FTX scandal, copped pleas and spilled the beans on Bankman-Fried during his high-profile trial.

Designed by Morris Adjmi Architects, this penthouse was once listed for a staggering $40 million after the FTX bankruptcy bombshell in November 2022.

However, any hopes of a quick sale were dashed as FTX bankruptcy honchos swiftly moved to safeguard the company’s assets amid court-ordered liquidation proceedings.

Now, under FTX’s firm grip, this sumptuous penthouse is poised to hit the market in the coming weeks, as revealed in recent court filings.

Fifteen other properties within Albany resort community

Court records reveal that FTX is also gearing up to offload a slew of prime real estate assets in the exclusive Albany resort community, with a total value of $151 million.

Aside from the iconic Orchid penthouse, prospective buyers can vie for a slice of paradise in 15 other properties within Albany.

These include multiple condos spread across prestigious buildings like Charles, Choral, Cube and Gemini, offering a taste of luxury living at its finest.

But FTX’s real estate fire sale doesn’t stop there.

Seven luxury condominium units in the coveted Goldwynn Resort & Residences, boasting panoramic views of Goodman’s Bay, are also up for grabs, with a combined value of $7 million.

Not to be outdone, four condos valued at $5 million in the esteemed One Cable Beach development are hitting the market, once inhabited by Bankman-Fried’s inner circle, including Singh and Wang.

Commercial properties, valued at a whopping $25 million, are also on the chopping block, featuring prime office spaces in prestigious locations like the Veridian Corporate Center and Pineapple House.

Even the West Bay property earmarked for FTX’s headquarters will change hands as the company liquidates its assets.

The sale isn’t confined to swanky resorts and corporate offices. An unspecified property on Blake Road and two sprawling lots in the exclusive Old Fort Bay enclave are also on offer.

Sam Bankman Fried’s parents’ ‘Blue Water’ property

As the fallout from the FTX cryptocurrency scandal continues to unfold, one luxurious Bahamian abode remains a symbol of lingering legal entanglements and unanswered questions.

Dubbed “Blue Water,” the sprawling 30,000-square-foot vacation home nestled in the exclusive enclave of Old Fort Bay stands as a testament to the opulent lifestyle once enjoyed by Sam Bankman-Fried’s parents, Joseph Bankman and Barbara Fried, both Stanford Law professors.

Purchased for a staggering $16.4 million in February 2022, Blue Water boasts beach views and epitomizes luxury living. However, its ownership has been shrouded in controversy since allegations surfaced that FTX footed the bill for the property.

Despite assurances from Bankman and Fried that they intended to relinquish ownership voluntarily in the wake of FTX’s collapse, legal wrangling has persisted.

According to court documents, the property’s title remains in their names, prompting FTX to pursue legal action against the couple.

In a recent twist, Bankman and his attorney, Krystal Rolle, informed Realtor.com that the property’s title had been transferred to a Bahamian company over a year ago.

Rolle asserted that the transfer had been finalized, potentially paving the way for the home’s sale to satisfy customer claims in FTX’s bankruptcy proceedings.

However, concerns linger over whether the sale will recoup the property’s full value, with FTX’s attorneys raising allegations of negligence on the part of Bankman and Fried.

Accusing the couple of turning a blind eye to FTX’s questionable business practices, they lambasted them for accepting a lavish home funded by the now-defunct company.

Amid the legal quagmire, it remains unclear when Blue Water will hit the market, leaving its fate hanging in the balance as FTX’s bankruptcy administrators grapple with the complexities of untangling the web of deceit woven by Bankman-Fried and his associates.

Requests for comment from FTX’s bankruptcy administrators went unanswered.