The Supreme Court on Wednesday weighed a bid from chipmaker Nvidia as it attempts to avoid a suit alleging its executives mislead investors about the extent its sales depended on volatile cryptocurrency miners.

Nvidia asked the Supreme Court to reverse a lower appeals court’s decision that a suit brought by company stockholders met the high legal bar to move forward with securities fraud allegations against the chipmaker.

Some of the justices appeared hesitant about the Supreme Court’s involvement in the legal matter, suggesting the case might not require a blanket rule to make it more difficult for securities fraud claims to be brought forward.

“It’s less and less clear why we took this case and why you should win it,” Justice Elena Kagan said during Wednesday’s oral arguments.

The allegations date back to 2018, when the company announced it missed revenue projections for the prior quarter and expected a year-to-year decline in its total revenues for the following quarter.

Over the next two trading days, Nvidia’s stock price fell by 28.5 percent.

Nvidia offers graphics processing units (GPUs), which are largely used for video games but can also be used in the mining of cryptocurrency. The crypto market is known to be extremely volatile, meaning the demand for these GPUs can fluctuate.

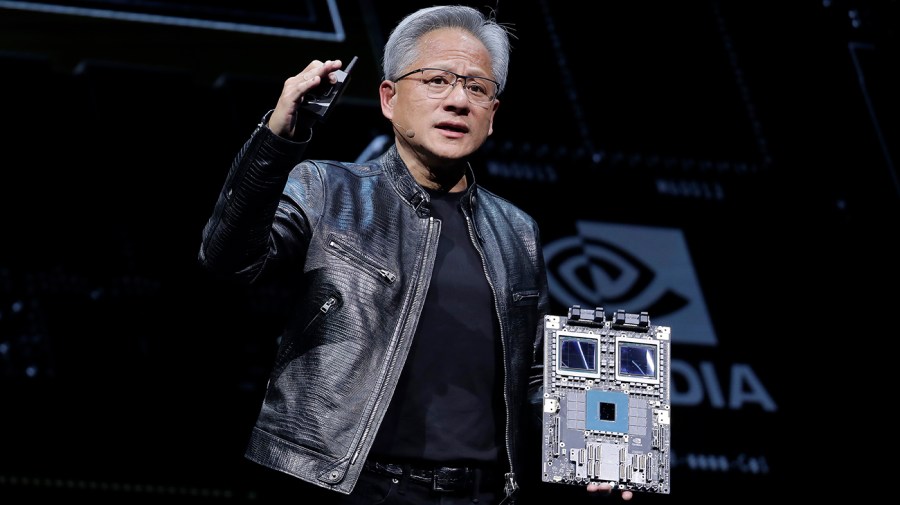

Following the earnings release, Nvidia CEO Jensen Huang told analysts, “The crypto hangover lasted longer than we expected.”

A group of shareholders who held Nvidia stock in the months ahead of the company’s dipped projections argue Huang and the company misled them about how much of company revenue depended on crypto mining and, in turn, the associated uncertainty of sales.

The suit was initially dismissed, but the Ninth Circuit Court of Appeals in San Francisco reversed part of the decision last year, prompting Nvidia to request the Supreme Court’s involvement.

Nvidia has pushed back, arguing Swedish investment firm Ohman J:or Fonder – the lead plaintiff – did not meet the legal bar set by the Private Securities Litigation Reform Act, a 1995 federal law designed to prevent frivolous securities litigation.

Ohman’s case contended there was a mismatch between Nvidia executives’ public statements and internal company documents.

“When analysts repeatedly asked him [Huang] if crypto was driving gaming sales, he called this wrong, claiming that crypto’s effect was ‘small but not zero.’ He didn’t express uncertainty. He said, ‘we know the market’s every move, we are masters at managing our own channel,’” Deepak Gupta, attorney for the plaintiffs, told the justices.

The plaintiffs did not have access to these documents at this stage, meaning the claims are mostly based on anecdotes of former employees, market analyst reports and Huang’s comments to analysts.

Nvidia took issue with this, arguing Ohman has not provided enough details to meet the federal standards with the evidence they have provided without speaking to the document content itself.

“It’s dangerous to say this amount of detail is enough for a complaint,” Nvidia’s attorney, Neal Katyal said Wednesday, adding, “And you certainly have to reject their new idea that these employees are enough because they don’t indicate when the CEO knew something.”

Katyal also pushed back against the firm’s citing of two expert opinion reports, claiming they lack detailed methodology and comparative analysis to test their reliability.

“If the report disclosed the methodology, how it got there, as opposed to relying on ‘proprietary data’ that they never tell us, and was able to surmount all of the problems that the big, huge gaps in inference that our brief details…if you know, didn’t treat crypters and crypto miners and gamers as different people when they’re often the same if you jumped through all that, yes, we think a report like that could be helpful,” Katyal quipped.

“In this case, it’s miles and miles away from that. This is a report that, yes, they went to Harvard, but beyond that, I don’t think it can tell you very much about the state of the reality of the world,” he added.

Gupta called Nvidia’s claim “an inaccurate characterization” of one of the reports, claiming economic consulting firm Prisym Group was “basically” doing “math.”

“It was taking publicly available figures and doing some multiplication,” he said.

Should the Supreme Court block the class action from proceeding against Nvidia, the ruling would likely heighten the current legal standards required in similar types of suits.

The high court seemed on the fence over whether it would allow the case to move forward.

“Is this entire case just an error correction? Or are these particular documents not precise enough? I’m not actually sure what rule we could articulate that would be clearer than our cases say already,” Justice Sonya Sotomayor asked Katyal.

Chief Justice Roberts questioned if there could be a compromise on the issue.

“Now, if I think that the positions on both sides are a little too absolute, how do you find that sort of sweet spot in terms of when the PSLRA is satisfied?” he asked Katyal. “I mean, it can’t just be a little of direct evidence because that statute was intended to do something. On the other hand, it seems to me you can’t insist on only direct evidence before a complaint goes forward.”

Katyal responded that his proposed “rule” would allow for circumstantial evidence, not just direct evidence, but at a minimum, the plaintiffs must show, “What specifically did the CEO know and when did he know it?”

The case before the high court comes nearly two years after Nvidia reached a $5.5 million settlement with the Securities and Exchange Commission (SEC) that it failed to disclose in two filings that crypto mining was a major source of revenue growth from GPU sales designed and marketed for gaming.

As part of the settlement, Nvidia neither admitted or denied the SEC claims.

The case is one of two class-action lawsuits against tech companies before the Supreme Court for the November sitting. Last week, the high court heard from Facebook as it sought to block a shareholder lawsuit over the Cambridge Analytica data scandal.

Ella Lee contributed reporting.